Sydney-headquartered world brokerage agency Macquarie, in its newest report, mentioned it’s totally different this time for the IT firms, in comparison with earlier recessions. The agency believes the India tier-I is a lovely territory.

Macquarie has upgraded Wipro to ‘outperform’ from ‘impartial’ and mentioned that TCS and HCL Applied sciences would stay their high picks. Nonetheless, given the sharper correction in HCL Applied sciences and the improved outlook for IMS, the brokerage has modified the pecking order to HCLT>TCS>Infosys>Wipro>TechM from TCS>HCLT>Infosys> Tech Mahindra>Wipro.

“We revised earnings throughout the board with updates following FY22 This fall outcomes and up to date USD-INR assumptions at 77.6,” mentioned Ravi Menon, an analyst at Macquarie Capital.

This time it’s totally different. However, why?

“When India Tier-1 have been a lot smaller gamers and performing as suppliers of expertise and never options, the impression on them was extra extreme,” mentioned Macquarie.

Put up-global monetary disaster, India Tier-I grew to grew to become strategic companions and usually are not prone to be as impacted by minor cuts in IT budgets which might be prone to fall first on smaller companies which might be workers augmentation suppliers.

Additional, Macquarie mentioned they may even be beneficiaries of vendor consolidation offers. “We don’t anticipate ‘knee-jerk reactions’ from any companies because the baseline expectation is that if there’s a US recession, it will likely be gentle,” mentioned the Macquarie report.

Macquarie believes even companies that did phenomenally effectively in the course of the pandemic, and are dealing with income and margin headwinds now, usually are not anticipated to slash know-how budgets. Nonetheless, they may scale back journey prices, restrict the extensions granted to extremely experimental initiatives, and are prone to shrink budgets by ~1 per cent.

JP Morgan, Nomura forecasts

The optimistic forecasting from Macquarie comes after current downgrades of frontline IT shares from JP Morgan. It downgraded TCS, HCL, Wipro and L&T to ‘underweight’ from ‘impartial’ and slashed its goal value by 15-21 per cent over margin, income considerations, surging inflation, and provide chain points within the wake of the Russia-Ukraine struggle.

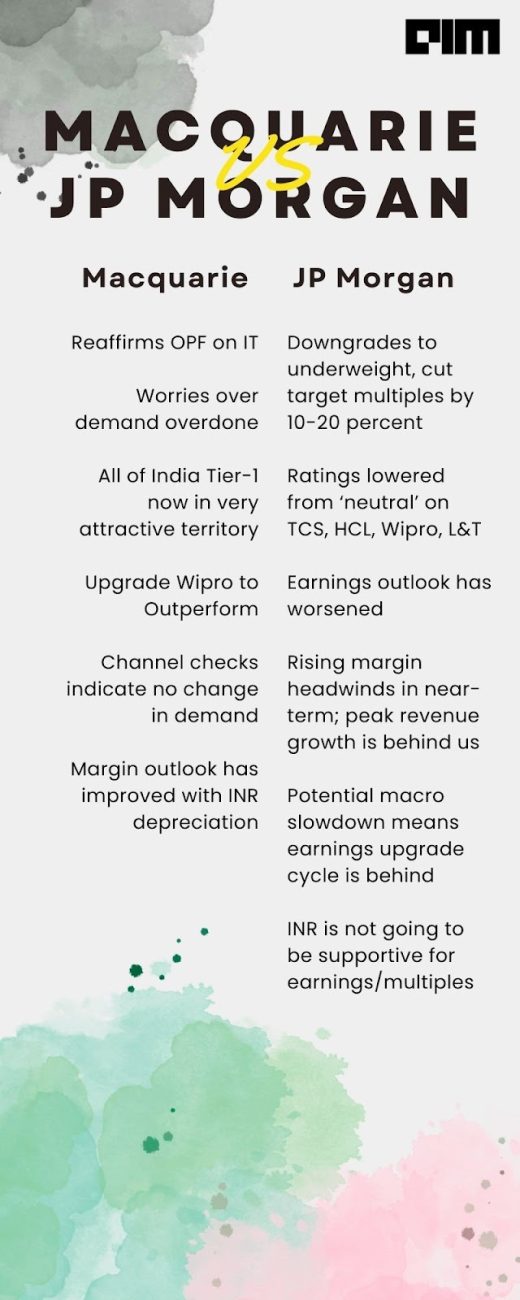

Right here’s a fast overview of the Indian IT sector by Macquarie and JP Morgan:

In the meantime, Japan-headquartered world brokerage agency Nomura has additionally downgraded a number of frontline IT firms, together with TCS, L&T, Wipro, HCL Know-how, Infosys, within the face of decline in income.

Worries over demand overdone

Macquarie mentioned that, not like within the 2000s, Indian Tier-I IT companies companies are strategic companions and never glorified staffing suppliers who would be the first to bear the brunt of cuts.

In different phrases, the income isn’t capped the identical approach as within the case of tech distributors/staffing suppliers. Which means, if you’re a staffing supplier, you’ve flat charges, However, if you’re a strategic associate, you get a proportion of the income. So, if the organisation grows, your income additionally grows.

Macquarie mentioned BFSI is the largest vertical for many Indian Tier-1, and demand appears resilient, citing JP Morgan that has upped CY2022 tech spending by 12.8 p.c. “We expect companies that select to chop again shall be risking long-term competitiveness,” mentioned Macquarie.

Macquarie mentioned that know-how investments are like a nuclear arms race, and the place one financial institution leads, others should observe.

As per Macquarie’s Asia know-how group, the server demand isn’t slowing. It mentioned that ‘server/networking tracker: stays constructive on datacenter server progress’ as of Might 2022.

The agency’s channel checks point out no change in demand, barring slight declines in particular segments. The corporate mentioned no materials modifications have been carried out to the demand surroundings for India Tier-I and any value financial savings makes an attempt are prone to result in vendor consolidation, favouring bigger companies.

However how did they arrive to this conclusion? Usually, the brokerage goes to totally different customers to examine if the IT firms’ demand has modified. If the customers (say a manufacturing or manufacturing firm) say that they’ve stopped utilizing them, they may scale back quantity.

Macquarie mentioned even retailers who’ve reported slowing gross sales or are warning of margin pressures proceed to spend increased on CAPEX.

For instance, Goal has raised its CAPEX steerage for CY22 to the upper finish of its earlier steerage of USD 4-5 billion although solely 55 p.c of its gross sales come offline now and on-line continues to develop quicker than offline. In the meantime, different retailers similar to Macy’s are seeing improved outcomes quickly as prospects change to increased costs and higher-margin merchandise similar to workplace put on and garments for particular events.

Menon mentioned the drivers for digital transformation are linked to enterprise technique, and the know-how modifications are anticipated to ship both increased income or decrease prices or each. He mentioned there’s a robust enterprise case to proceed spending, as years of investments to remain forward of friends will be undone by a short-sighted cost-cutting measure.

Macquarie mentioned the demand they noticed over CY21 is not only pent-up demand however a sign of the largest know-how refresh in Enterprise know-how landscapes because the adoption of internet applied sciences and ERP within the 2000s.

In different phrases, the 2021 increased P/E and IT valuations weren’t due to the 2020s lows. As an alternative, it was attributable to increased adoption. Life-time-value (LTV) of SaaS and tech in a B2B setting is at the least ten years, and there’s no cause for the business to fret now.

Menon mentioned whereas there may be some correlation between S&P 500 revenues and tech spending, individuals shouldn’t anticipate a like-to-like transfer as this ignores value deflation in {hardware} and value deflation within the 2000s from embracing offshore execution.

Alternatives within the time of disaster

Macquarie believes that simply because the financial system does badly doesn’t imply the recession seeps into IT. On the intense aspect, the demand is prone to proceed for IT with digital transformation occurring throughout industries.

Nonetheless, Macquarie mentioned it expects minor pockets of slight spending cuts (dwelling enchancment). Citing Broadcom VMware, it anticipated further alternatives, similar to elevated M&A, alongside industries bouncing again and growing spending, significantly in journey and hospitality, power, and so on.

Affect of depreciating INR

As per ET, the Indian Rupee has depreciated 3.5 p.c towards the USD in 2022. Furthermore, the Rupee has depreciated by over 1.2 p.c in the previous few months alone. In distinction, in 2017, the Rupee stood at INR 64.60 towards the greenback; right now (on the time of writing), it was about INR 77.63.

Macquarie mentioned not like the INR depreciation in 2014/15, INR depreciation advantages shall be partly retained by distributors this time, given that is nonetheless a supply-constrained market and prone to stay so.

The brokerage mentioned it expects attrition to be average, given giant contemporary graduate hiring in FY22 throughout all companies. It initiatives gross margins to start out increasing in FY22 Q3, as FY23 contemporary graduate hiring and wage hike impacts ease and utilisation enchancment, and pyramid levers (i.e. contemporary addition) play out.

Is the IT sector recession-proof?

Macquarie mentioned the IT spending appears recession-proof, with US computer-related employment down simply 0.3 p.c over 2008-09 and 0.8 p.c over 2009-10. For example, the US employment in computer-related occupations has elevated from 2.03 million jobs in 1997 to three.54 million jobs in 2007, 4.56 million jobs in 2017, and 5.07 million jobs in Might 2021.

US employment in computer-related occupations excluding pc science academics (Supply: Macquarie Analysis)

In comparison with the remainder of the world, the Indian IT sector has all the time had increased resistance to recession and survived the 2008 monetary disaster, the dot-com bubble, and the pandemic unscathed. Nearly all of the main IT firms grew considerably throughout these essential instances due to their robust fundamentals and surplus money reserves. For example, Infosys clocked 19.7 p.c income progress in the course of the pandemic (2021-22).

Even when the US recession hits the Indian shores, this can work within the IT sector’s favour as a result of most of them are prone to redirect their outsourcing work/initiatives to international locations like India, the Philippines, due to the associated fee advantages and tech expertise obtainable in these international locations.

A examine performed by Korn Ferry confirmed India is projected to have a talented labour surplus of 245 million staff by 2030. The agency mentioned, whereas the world would face a tech expertise crunch, India is predicted to guide with over a million surplus expert tech staff.