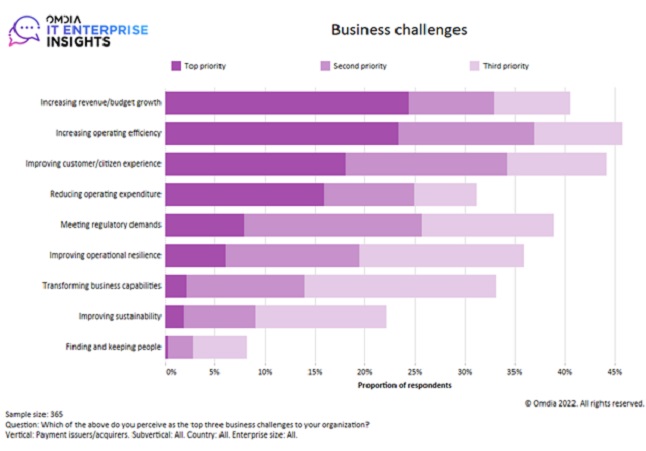

If 2021 was centered on progress and scale, and 2022 noticed cost-cutting and survival as key aims, then 2023 is a 12 months to goal for stability. A difficult macroeconomic local weather is forcing fee issuers and acquirers to prioritize income progress and working effectivity, seen as the highest precedence by 25% and 24% respectively of respondents. Bettering sustainability was surprisingly low down as a enterprise problem: fewer than 25% of respondents put it of their prime three. Concentrate on sustainability presently features a shift to completely digital processes, eco-friendly playing cards, and carbon footprint calculators. Although many companies have been pressured into mass redundancies, “discovering and conserving individuals” is a precedence for fewer than 10% of organizations.

Actual-time Funds Nears Tipping Level Towards Mainstream Adoption

The growing proliferation of real-time networks globally has introduced real-time funds (RTP) to the fore, with 23% of respondents indicating it’s their prime precedence by way of product improvement and an additional 26% together with as second and third precedence. India’s UPI community, launched in 2016, is now the most well-liked approach customers transact on-line and is processing greater than 6.5 billion transactions a month. Brazil unveiled its real-time community, PIX, in November 2020 and has since registered greater than 133 million customers (62% of the nation’s inhabitants) and reached month-to-month transaction volumes of over 2.5 billion. The success of India’s UPI and Brazil’s PIX places stress on the 2023 launches of FedNow within the US and P27 within the Nordic international locations to speed up mainstream adoption globally.

There’s a lot anticipated of the long-awaited FedNow with the community set to launch in mid-2023 and can waive charges initially to assist drive adoption, with the real-time fee rail aiming to distinguish itself from the financial institution owned RTP Community by reaching extra broadly to small cities and banks. Equally, South Africa’s prime 4 banks are rolling out PayShap, a real-time digital funds service aimed toward growing monetary inclusion to the underbanked section.

Open Banking Funds Awaits ‘Hero’ Use Case to Drive Demand

January 13, 2023, marked 5 years since open banking was first launched by the UK’s Competitors and Markets Authority. The UK is now recurrently seeing month-to-month API calls of over 1 billion and reaching a maturity whereby open banking rails are being more and more used for extra advanced use circumstances, one instance being funds.

Thirty-eight % of respondents in Omdia’s survey of funds issuers/acquirers acknowledged that they noticed “new fee providers” as considered one of their prime three alternatives because of open banking. Europe and North America see probably the most potential in open banking funds with greater than 40% of respondents agreeing it’s of their prime three alternatives.

Many of those funds are for funds transfers and pockets top-ups, however more and more retailers are accepting it instead technique to card funds. J.P. Morgan, NatWest, and Financial institution of America have all now launched “pay by financial institution” merchandise that make the most of the open banking rails. NatWest’s Payit has already processed greater than £1bn value of transactions within the two years since launch.

2023 might be a tipping level for open banking funds within the UK and the US with “new fee providers leveraging open banking APIs” being a prime IT product funding precedence for nearly one in 4 (23%) UK respondents and one in 5 (20% US respondents, in accordance with Omdia’s 2022/23 survey of fee issuers/acquirers. Variable recurring funds (VRP) are being labeled the breakthrough use case: VRP is a extra fashionable, safe, and versatile approach of amassing common funds for companies and shoppers than the standard however inefficient direct debit or ACH system. Given the recognition of subscriptions and choice for utility companies to gather common funds, VRPs might be the hero use case, providing flexibility to prospects, that accelerates adoption within the UK, the US and the remainder of the world.

Safety Is the Prime Driver for Fee Infrastructure Funding

The growing sophistication of fraud has prompted fee issuers/acquirers to prioritize funding in safety/antifraud: almost half of respondents mentioned it’s of their prime three IT tasks, and 32% of respondents are growing their spend by 6% or extra. There has additionally been a big uplift in fee scams, the place people are tricked into authorizing funds to criminals. That is also called licensed push fee. This has prompted the funds trade to extend investments to scale back the chance of fraud, monetary crime, and information loss.

Given this context, it’s no shock that monetary establishments (FIs) are putting excessive strategic significance on safety and fraud administration. Moreover, Omdia’s Fee Know-how Spending By 2026: Enterprise Perform forecasts sturdy progress in fraud administration spending, with funding set to extend by a compound annual progress price of 5.7% between 2021 and 2026.

In preventing fraud and monetary crime, monetary establishments face some particular challenges. First, there may be the necessity to preserve tempo with new varieties of fraud and new patterns of fraud, as exemplified in the course of the pandemic. Second, fraud prevention methods must be extra correct to scale back excessive numbers of false positives. Due to this fact, banks want to make sure their methods can adapt shortly to detect and mitigate these new threats and keep away from losses and friction with shoppers.

Philip Benton is a principal fintech analyst at Omdia and writes evaluation on the problems driving technological change in monetary providers.

You will discover extra of Philip’s views on fintech by way of LinkedIn or comply with him on Twitter @bentonfintech.